Eligibility Assessment

Identifying qualifying research activities to maximize tax credit claims.

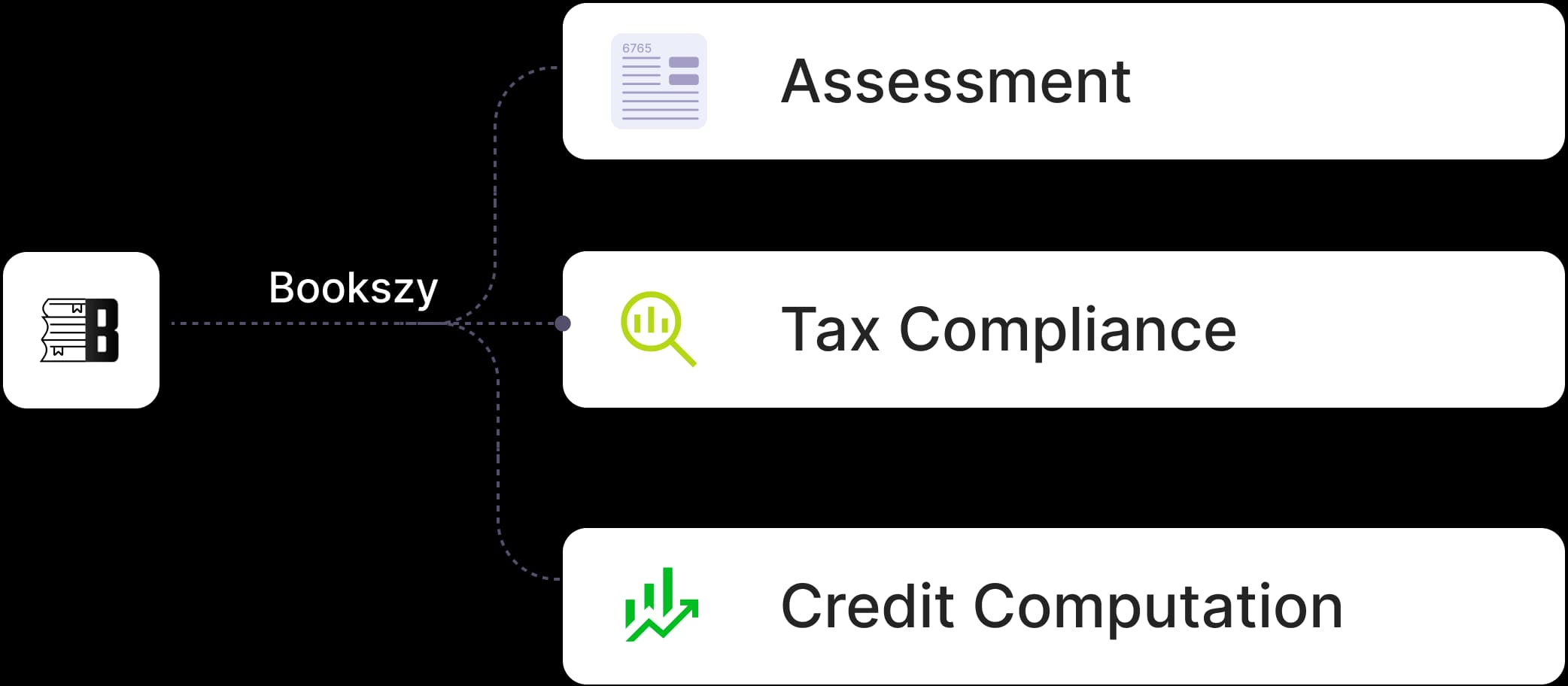

Bookszy: Unlock Innovation with Smart R&D Tax Credits With

Fuel innovation and maximize savings with our R&D credit advisory services! We help businesses unlock valuable tax incentives by identifying eligible research activities and optimizing claims, while staying compliant. Whether you're developing groundbreaking technology or refining processes, Bookszy ensures you get the financial rewards you deserve, without the hassle!

Identifying qualifying research activities to maximize tax credit claims.

Identifying qualifying research activities to maximize tax credit claims.

Perform precise credit calculations while optimizing financial benefits.

Perform precise credit calculations while optimizing financial benefits.

Deliver audit-ready documentation to meet regulatory requirements with confidence.

Deliver audit-ready documentation to meet regulatory requirements with confidence.

Tailor credit strategies for different industries to ensure maximum impact.

Tailor credit strategies for different industries to ensure maximum impact.

Assist with filing claim forms (e.g., Forms 6765, 8974) and handle inquiries from tax authorities.

Assist with filing claim forms (e.g., Forms 6765, 8974) and handle inquiries from tax authorities.

Provide strategic guidance to help businesses leverage R&D credits for sustained growth.

Provide strategic guidance to help businesses leverage R&D credits for sustained growth.

Claiming R&D tax credits can be complex, but we simplify the process with end-to-end support. From identifying qualifying activities to preparing documentation, we make it easy for you to secure valuable credits without the stress.

With years of specialized experience in R&D tax credit consulting, our experts help you maximize eligible claims, minimize risks, and ensure compliance with IRS guidelines. We make sure your credits withstand audit scrutiny with confidence.

Whether you’re building software, scaling a startup, or investing in product development, we tailor R&D tax credit solutions to your business. Our support turns innovation into savings-fueling reinvestment, growth, and long-term success.

Discover if your business qualifies for valuable R&D tax credits! With just a few quick questions, you'll know whether your research activities meet the criteria for tax incentives. Gain instant clarity on potential savings, next steps, and maximize your financial benefits-all while fueling innovation.

Get Started

Unlock maximum R&D tax savings with our expert guidance. We identify eligible activities, optimize claims, and provide audit-ready documentation-so you can fuel innovation without financial uncertainty.

Tax regulations are complex, but filing doesn't have to be. Our end-to-end compliance support and streamlined filing process ensure your business claims every available incentive while staying fully compliant with IRS and state requirements.

Bookszy makes innovation financially rewarding with expert R&D credit advisory services that fuel growth, enhance profitability, and help businesses stay ahead in competitive markets!

Schedule a call