Entity-Specific Tax Filing

Prepare and file tax returns for C-Corps, S-Corps, LLCs, Partnerships, or International Businesses (Forms 1120, 1120S, and 1065) in alignment with the latest IRS guidelines.

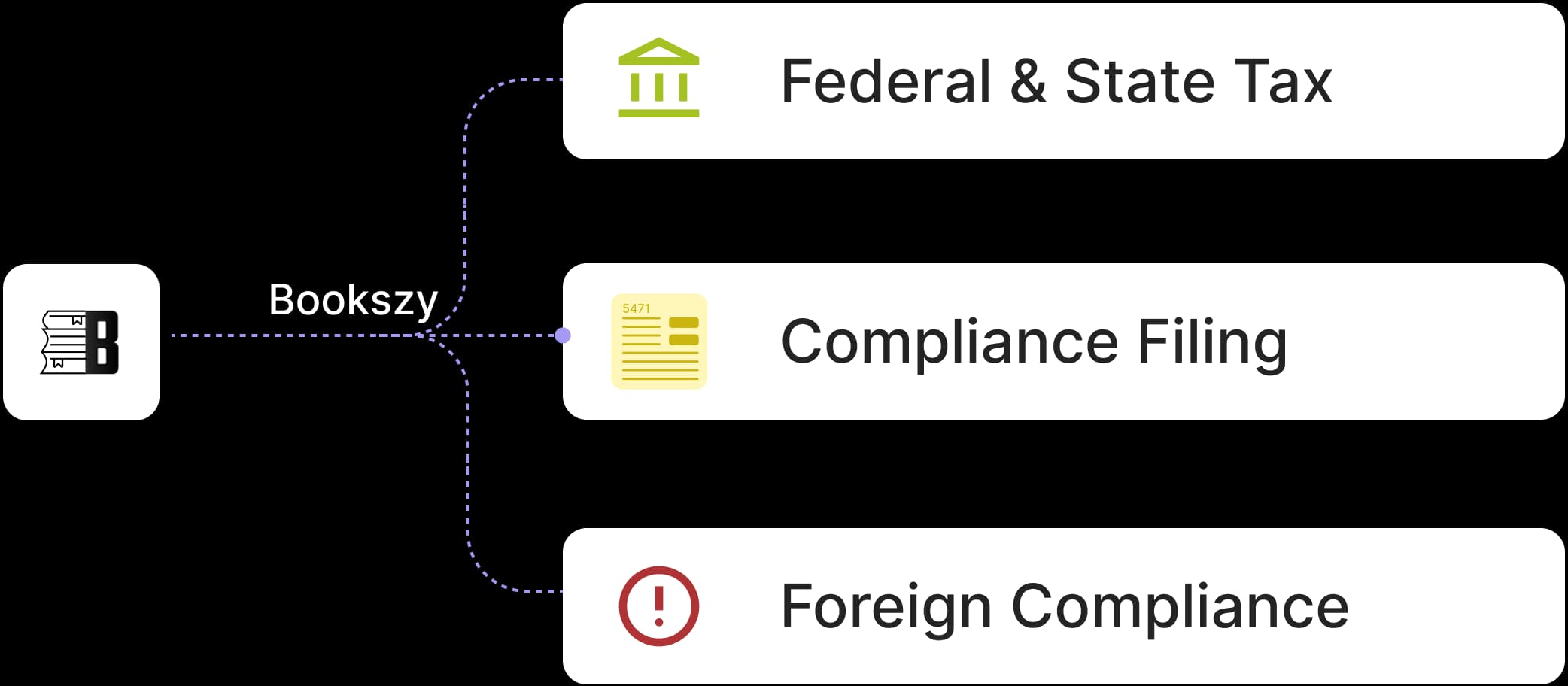

Effortless Business & Corporate Tax Filing with Bookszy

We make tax filing stress-free with accurate, on-time, and compliant filings tailored to your entity type. Forget tax deadlines-experience seamless compliance and uninterrupted business growth with Bookszy.

Prepare and file tax returns for C-Corps, S-Corps, LLCs, Partnerships, or International Businesses (Forms 1120, 1120S, and 1065) in alignment with the latest IRS guidelines.

Prepare and file tax returns for C-Corps, S-Corps, LLCs, Partnerships, or International Businesses (Forms 1120, 1120S, and 1065) in alignment with the latest IRS guidelines.

Accurate, on-schedule filings that cover federal and multi-state obligations—including Delaware franchise tax, California Statements of Information, and other state requirements. Access seasoned expertise through EA consultation.

Accurate, on-schedule filings that cover federal and multi-state obligations—including Delaware franchise tax, California Statements of Information, and other state requirements. Access seasoned expertise through EA consultation.

Easily file your Foreign Bank and Financial Accounts (FBAR, FinCEN Form 114) report if your company or subsidiary has foreign accounts exceeding $10,000. We ensure IRS readiness with timely data collection and secure e-filing.

Easily file your Foreign Bank and Financial Accounts (FBAR, FinCEN Form 114) report if your company or subsidiary has foreign accounts exceeding $10,000. We ensure IRS readiness with timely data collection and secure e-filing.

Specialized IRS support for corporate taxpayers, including C-Corps (Form 1120) and S-Corps (Form 1120-S). Services include reviewing IRS audit notices, preparing financial records, defending tax positions, and negotiating with the IRS to minimize adjustments and penalties.

Specialized IRS support for corporate taxpayers, including C-Corps (Form 1120) and S-Corps (Form 1120-S). Services include reviewing IRS audit notices, preparing financial records, defending tax positions, and negotiating with the IRS to minimize adjustments and penalties.

Get professional support and representation in case of an IRS audit, CP2000 notices, or correspondence requiring clarification.

Get professional support and representation in case of an IRS audit, CP2000 notices, or correspondence requiring clarification.

Simplify international tax compliance with expert filing of Form 5471 (Information Return of Foreign Subsidiaries) and Form 5472 (Information Return of Foreign Shareholders). From accurate reporting to timely submissions, we keep your global business IRS-compliant.

Simplify international tax compliance with expert filing of Form 5471 (Information Return of Foreign Subsidiaries) and Form 5472 (Information Return of Foreign Shareholders). From accurate reporting to timely submissions, we keep your global business IRS-compliant.

Taxes don't have to be stressful. We simplify the process with accurate, timely, and efficient tax preparation. From federal to state filings, we handle the details so you save time, avoid penalties, and stay compliant year-round.

Our experienced tax professionals ensure precision with every return. With deep knowledge of ever-changing tax laws, we help minimize liabilities, maximize deductions, and keep your business compliant with confidence.

Whether you operate in one state or across multiple locations, we streamline your tax compliance. By consolidating obligations, syncing deadlines, and ensuring audit readiness, we let you focus on expansion while we manage the paperwork.

Stay effortlessly ahead of your tax obligations with Bookszy! Learn about key federal and state due dates based on your business structure with our Filing Deadline Tracker. Regardless of your entity type, Bookszy keeps your compliance timeline organized, timely, and easy to follow!

Get Started

Every return is reviewed with expert insight to ensure compliance, minimize errors, and safeguard your business against penalties.

From federal to multi-state filings, Bookszy's tech-powered platform keeps you ahead of deadlines, reduces risk, and frees up valuable time so you can focus on growth.

Tax season doesn't have to be stressful-Bookszy keeps you compliant, organized, and ahead of deadlines!

Schedule a call